Even though there is a constant evolution of methodologies for predicting shares of newly developed or revised products, we still see in all conjoint models and in non-conjoint share allocation exercises an overstatement of modeled preference share relative to actual market share.

Acceptance of an overstated share can have significant impact for an organization, so it is important to adopt an effective approach to adjust an overstated share to a more realistic level.

The simplest adjustment approach, although not recommended, consists of a rule of thumb adjustment coefficient (e.g., preference share reduced by 30%). Applying the same adjustment coefficients to all respondents (all respondent types, all geographies, all segments, etc.) is hardly justifiable and virtually always leads to unrealistic estimated shares.

A much better approach is collecting purchase (or usage, prescription, adoption, etc.) probabilities via the Juster’s 11-point scale:

- this scale should be asked once for the main product profile, immediately before the (conjoint or non-conjoint) share allocation exercise;

- the idea consists of adjusting the respondent’s increment (or decrement) in share(s) for the newly developed or revised product(s), between the current stated and the future stated scenarios, based on the respondent answer’s to the Juster question;

- this is done by assigning a specific probability coefficient to each response category of the Juster scale;

- future shares for the products for which the Juster question is not asked are adjusted accordingly.

R-sw is the only commercial software that allows you to Juster calibrate shares data. The calibration function is offered within both the packages R-sw Conjoint and R-sw Discriminant.

Standard Juster Scale

The function juster.calibration available in both R-sw Conjoint and R-sw Discriminant provides adjustment of shares for overstatement via the Juster’s 11-point purchase probability scale. It is possible to use either the standard Juster probability coefficients of the Juster scale (as in the table above) or to assign ad-hoc ones.

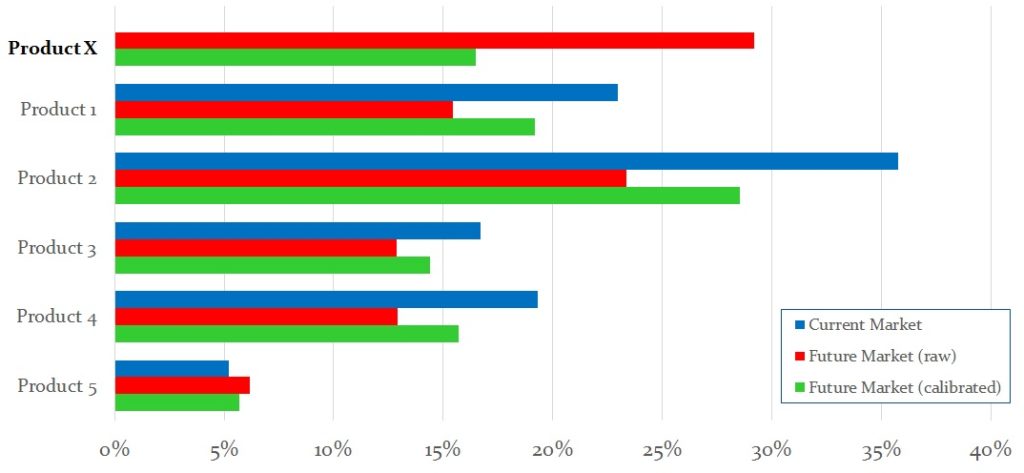

In the example below, the future estimated share for Product X has been reduced via Juster calibration to account for respondents overstatement. The shares for the other market players are adjusted accordingly based on:

- the impact that calibration has on Product X share and

- the share gap, for each market player, between the current and future scenarios.